Can health insurance make firms sick?

- November 15, 2016

- By Melody Walker

- 3 minute read

New research from Olin sheds light on the relationship between employee benefits and the profitability and competitiveness of small businesses. Ulya Tsolmon, Assistant Professor of Strategy at Olin and her co-authors at Duke’s Fuqua School of Business, reviewed data on some 15,000 firms over the 2004−2010 time period—before implementation of the Patient Protection and Affordable Care Act—to compare the labor productivity, employee turnover, profitability, stability, and growth rate of companies that voluntarily offered their employees health insurance and those that did not.

Providing health insurance is typically very costly, especially for small firms. Small firms generally pay more for health insurance per employee than larger firms because they have fewer employees and therefore smaller risk pools. Is the payoff for a small firm worth this investment? How do small businesses that provide health insurance fare compared to their counterparts that do not?

One key finding was that following the economic crisis of 2007, firms that did not offer health insurance lowered employee wages by an average of 25 percent; by contrast, the average wages in firms offering health insurance declined only 5 percent during the same period. Further, firms that did not provide their employees with health insurance laid off a larger percentage of their workforce during the Great Recession than did firms providing health insurance.

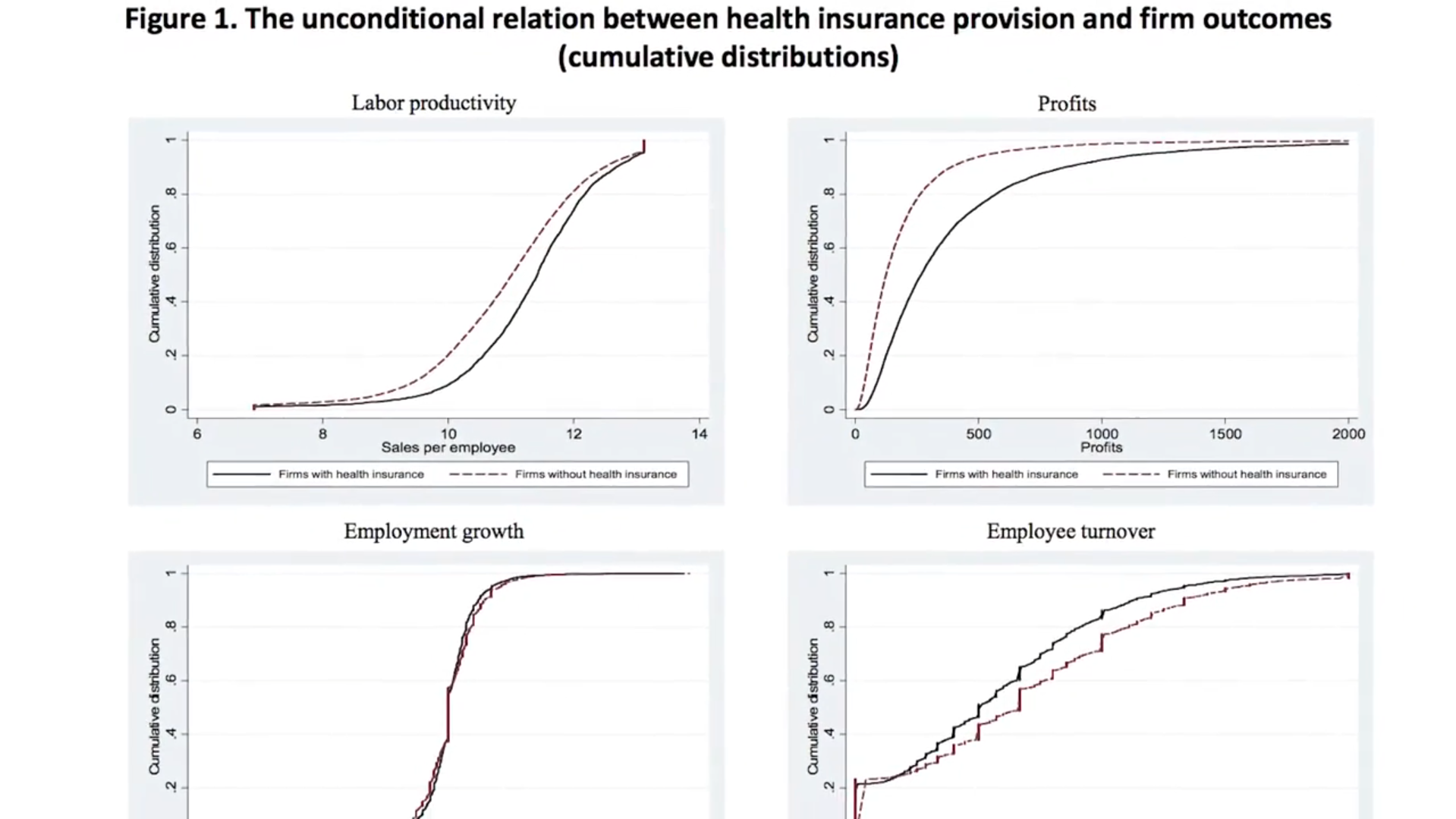

In comparison, the group of firms providing health insurance had a much lower employee turnover rate, higher profitability, and higher sales per employee. However, the average growth rate of the group that provided health insurance was lower when compared to the group not providing health insurance.

The cause of this discrepancy? The study results seem to indicate that firms with health insurance enter into an implicit contract with their employees: The firm shields employees from economic downturns but asks them to exert effort and commitment to increase the firm’s performance. However, according to lead researcher Ulya Tsolmon, “firms with health insurance seem to be more cautious than those without health insurance when expanding, as making and keeping commitments to employees is not an easy task, especially during economic downturns.”

This study offers important insights for policymakers—especially with the Patient Protection and Affordable Care Act, including the question of whether to expand the employer mandate on health insurance to businesses of all sizes, likely to return to the congressional agenda early in 2017. Inasmuch as 99 percent of all US companies are small businesses that together employ more than 50 percent of US workers, expanding the mandate to require these firms to offer health insurance clearly has the potential to dramatically increase the number of insured Americans. But any such discussion, the researchers note, should include consideration of how a broadened mandate might affect the growth of these small businesses.

Paper title: “Health Insurance and Relational Contracts in Small American Firms,” under review R&R at Strategic Management Journal

Authors: Ulya Tsolmon, Assistant Professor of Strategy, Olin Business School, Washington University in St. Louis; Dan Ariely and Sharon Belenzon, Duke University, The Fuqua School of Business

Is Health Insurance Making Small Firms Sick?

New research sheds light on the relationship between employee benefits and the profitability and competitiveness of small businesses.

Media inquiries

For assistance with media inquiries and to find faculty experts, please contact Washington University Marketing & Communications.

Monday–Friday, 8:30 to 5 p.m.

Sara Savat

Senior News Director, Business and Social Sciences