Grant aids research on ripple effects of ACA subsidies

- June 18, 2018

- By Kurt Greenbaum

- 4 minute read

Emily Gallagher, an Olin postdoctoral research associate, has won a $35,000 research grant that will help underwrite her research into the relationship between healthcare costs, Medicaid availability, and Obamacare subsidies on housing security.

The research highlights the ways access to healthcare yields indirect financial benefits to households and society that go beyond physical well-being.

The grant comes from the Russell Sage Foundation, which is dedicated to underwriting social science research. The announcement of the grant came as Gallagher, who holds a joint appointment with the Brown School, was wrapping up a trio of research papers around questions of household savings, housing security, and earnings stability.

All three research papers lean heavily on a trove of data Brown attained through a partnership with a major tax preparation platform (which has asked to remain anonymous). Researchers have sliced and diced anonymized data from thousands of consenting tax filers and have posed survey questions through the tax platform. Gallagher’s research is part of a broader range of joint projects between faculty at Brown’s Center for Social Development and Olin.

Tying healthcare with housing security

Gallagher’s first paper looked at the effect of healthcare subsidies through the Affordable Care Act on rent and mortgage delinquency rates among low-income households. She found a 26 percent decline in home delinquency rates as households qualified for subsidies through the ACA. This is significant, she said, because the cost of foreclosures and evictions to society—costs borne by tenants, homeowners, landlords, neighboring homes, lien holders, banks—is substantial.

“You wouldn’t think giving people health insurance would reduce foreclosures and evictions, but it does,” Gallagher said. In the study, the average ACA subsidy was about $4,300. Under plausible assumptions, Gallagher said, 33 to 53 percent of that subsidy cost might be offset by the social savings associated with fewer evictions and foreclosures.

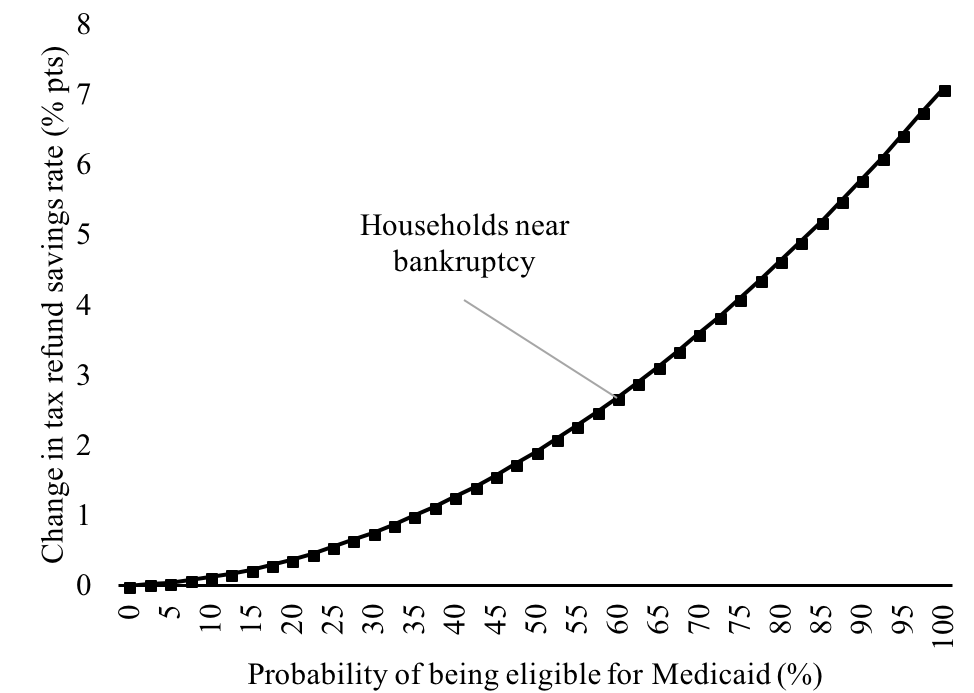

In the second paper, Gallagher looked at the Medicaid eligibility of 67,000 tax filers and their propensity to save a portion of their expected tax refunds for a rainy day. Researchers surveyed taxpayers just before receiving their tax refund, asking how much of the refund they intended to keep, use to pay down debt, or consume within the next six months.

In the second paper, Gallagher looked at the Medicaid eligibility of 67,000 tax filers and their propensity to save a portion of their expected tax refunds for a rainy day. Researchers surveyed taxpayers just before receiving their tax refund, asking how much of the refund they intended to keep, use to pay down debt, or consume within the next six months.

“When you look at households that are right on the verge of having to declare bankruptcy, they intend to save more when they gain access to Medicaid,” she said. In fact, the taxpayers say they intend to increase their savings by about 4.4 percent of the tax refund amount, or $93 on average. The savings, “modest in absolute magnitude, are substantial when compared to the impact of interventions explicitly designed to encourage saving among low-income and financially constrained households,” she wrote in the paper.

“It’s hard to nudge low-income households into saving more, but as it turns out, Medicaid is a successful way of doing that for households in the most trouble.” For households that are doing better, Medicaid appears to have no effect on their savings behavior.

Stabilizing income through better healthcare access

Preliminary results from Gallagher’s third paper, still in draft form, show a taxpayer’s access to a healthcare subsidy — and, as a result, health insurance — increases the person’s income stability. When people get treatment for chronic conditions, reliably take their medication, or address mental health issues, they’re more reliable workers and maintain jobs longer — leading to a steadier income.

“People are experiencing fewer unexpected variations in their income by being on the subsidy,” Gallagher said. Health conditions can cause “unexpected labor shocks” that destabilize income. To the extent that health conditions are exacerbated by a lack of health insurance, households with insurance tend to report fewer unexpected income shocks. In contrast, “when a person reports they have variable income because of expected factors, such as due to seasonal jobs, there’s no effect there.”

Gallagher led the research under the counsel of Olin’s Radhakrishnan Gopalan, professor of finance, and Michal Grinstein-Weiss, a professor and associate dean for policy initiatives at the Brown School.

The first paper, “The Effect of Health Insurance on Home Payment Delinquency: Evidence from ACA Marketplace Subsidies,” is under second review for publication. The second, “Medicaid and Household Savings Behavior: New Evidence from Tax Refunds,” is in the submission process. Gallagher is drafting the third paper “The Effect of Health Insurance on Earnings Stability: Evidence from the ACA Marketplace.”

“The broad thing we’re looking at is that we massively expanded our social safety net” by passing the Affordable Care Act, Gallagher said. “People think of it as just improving people’s health and, maybe, reducing medical bills. We’re looking at indirect financial outcomes that you wouldn’t expect health insurance to affect.”

Media inquiries

For assistance with media inquiries and to find faculty experts, please contact Washington University Marketing & Communications.

Monday–Friday, 8:30 to 5 p.m.

Sara Savat

Senior News Director, Business and Social Sciences