New Olin research: How valuable is early economic data?

- June 6, 2018

- By Guest Author

- 2 minute read

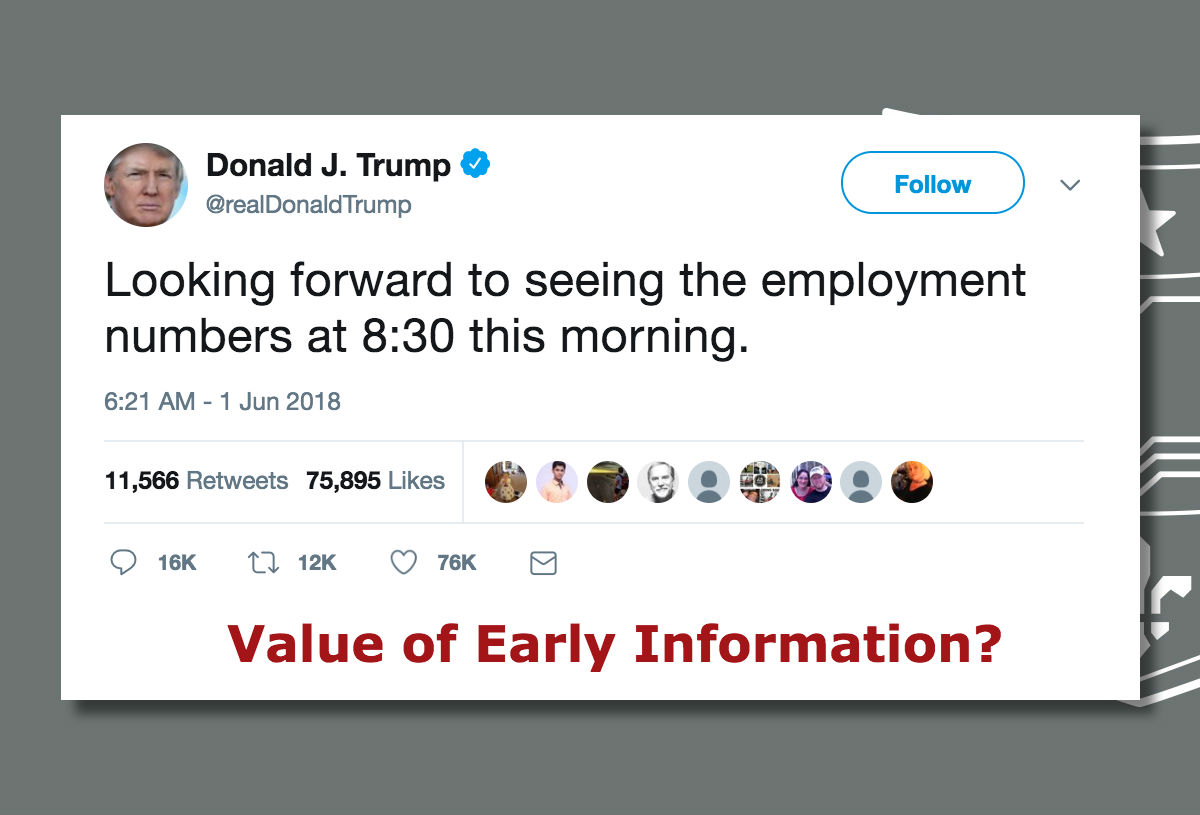

Asaf Manela, associate professor of finance, wrote this following President Trump’s tweet on Monday related to new employment statistics:

President Trump recently gave financial markets a hint that the May employment report, due to be publicly released only two hours later, would exceed market expectations. Interestingly, the previous National Economic Council Director Gary Cohn, concerned about such deviations from common practice, withheld jobs report data from the president until shortly before their release.

But this post is not about whether giving such advance information by a government official is legal or ethical. Instead, I would like to pose the question: How valuable is such advance information?

In a paper forthcoming at the Review of Financial Studies titled “Estimating the Value of Information,” Ohad Kadan and I provide an estimation framework that yields an answer to this and related questions. We illustrate our framework by estimating values of key macroeconomic indicators, ranking them and analyzing the determinants of this value.

Using changes in option prices around employment reports, we estimate that an investor would pay about $5 for every $10,000 of her or his wealth for a one-time, private peek into employment figures. A monthly subscription to such a service would be worth much more — about $2,300 for every $10,000 of wealth. Of course, for a large wealth management firm like a hedge fund, the value proposition is larger as it can spread the costs over a larger investor base.

The above estimates assume that the investor can trade on such private information at stale prices. If instead, the same information is made public a day earlier, as seems to be the case with the president’s tweet, we need to account for prices adjusting at the announcement.

When we do so, we find that the employment report is worth about 20 cents per release or $94 for a lifetime subscription, for every $10,000 of investor wealth. Is that large? Multiplying our estimates by $99 trillion current US household net worth, suggests that by publicly releasing the employment figures a day early, the president’s tweet could’ve generated a $2 billion gift to investors.

These numbers, as always, are not perfect and rely on several important assumptions discussed in the paper. Our paper contributes to a large prior literature that asks if certain information is valuable, by asking instead how much value information provides.

While we study macro indicators, future applications may use our methodology to rank firm-level information, such as earnings releases or analyst forecasts. Estimates of the value of information may prove useful for the pricing of information services and for the enforcement and litigation of insider trading.

Media inquiries

For assistance with media inquiries and to find faculty experts, please contact Washington University Marketing & Communications.

Monday–Friday, 8:30 to 5 p.m.

Sara Savat

Senior News Director, Business and Social Sciences