Laying groundwork for Olin’s family business center

- January 7, 2019

- By Guest Author

- 7 minute read

By Carlos Restrepo, originally published in the 2018 edition of Olin Business magazine.

Before launching Washington University’s first family business course, Olin Business School’s Spencer Burke felt confident in his knowledge of the topic. After all, Burke, principal at the St. Louis Trust Company, had worked as a corporate lawyer for 15 years and an investment banker for 25 years.

“It wasn’t until the course started that I came to understand just how difficult some of the issues are,” said Burke, an adjunct lecturer at Olin. “The challenge arises from the inherent complexity of doing two difficult things—often in conflict—simultaneously: One, having family harmony. And the second is running a successful business. Those are two very challenging tasks, especially when put together.”

In the five years since starting the course, Burke has taught students the complexities of family-owned business, an area of study he believes is necessary for students seeking any business career.

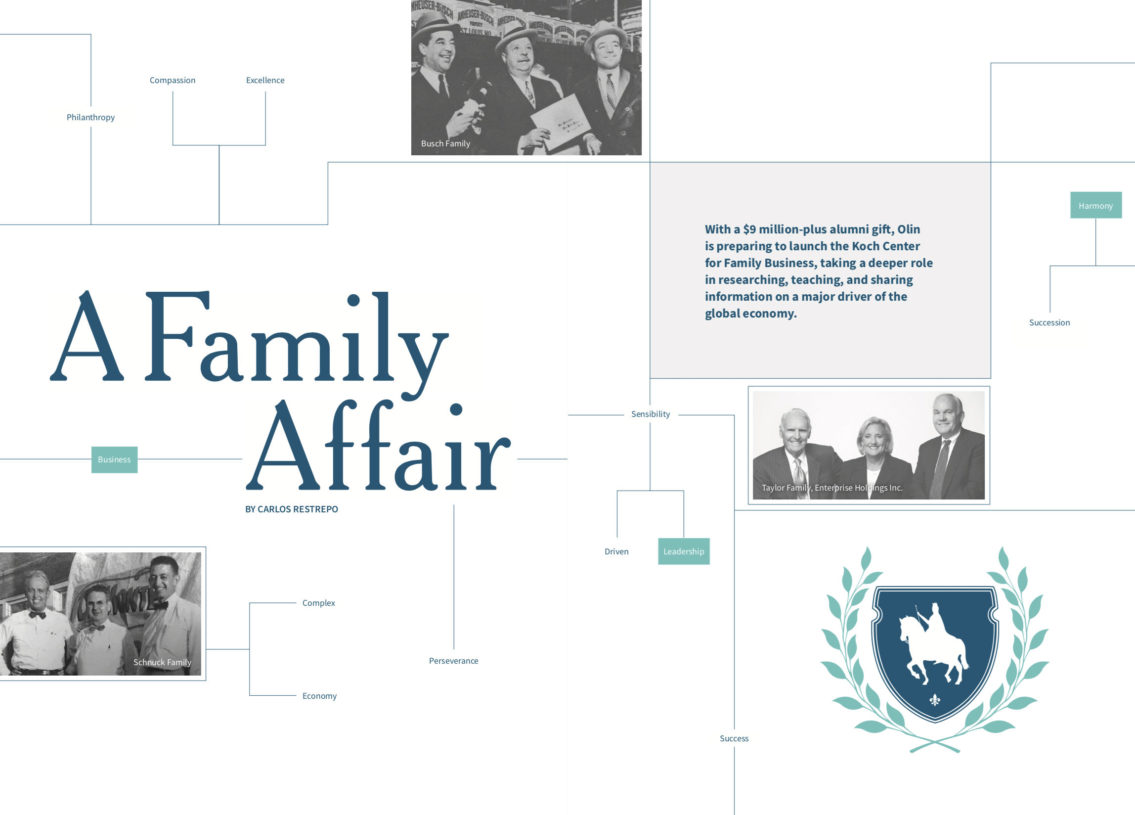

In fact, the need is great enough that Olin is well on the way to establishing a full-fledged research center on the topic. The Koch Center for Family Business is in the planning stages thanks to a donation of more than $9 million from Roger, Fran, Paul, and Elke Koch. Paul, BSBA ’61, JD ’64, MBA ’68, and Roger, BSBA ’64, MBA ’66, are co-chairmen of the board, and the third generation in leadership at Koch Development Co., a St. Louis-based developer and manager of commercial real estate and owner/operator of select entertainment attractions.

The Koch’s donation will also endow an Olin professorship and Dean Mark P. Taylor is seeking a candidate for the position, a faculty director for the new family business center. The center is the next phase of a family business program begun under former Dean Mahendra Gupta in 2016 with an initial $1.09 million gift from the Kochs.

“There are really three heroes in this,” Paul Koch said. “Mahendra, who comes from a family business in India and saw the need; Spencer Burke, who kept the fire burning; and Dean Taylor, who is an internationally experienced business leader and he picked up that this is a huge issue all over the world.”

The Koch Center for Family Business will not be a brick-and-mortar space, but rather a program within Olin aimed at developing research and disseminating knowledge into the dynamics of family businesses.

“This is not about creating some building or monolithic thing,” Burke said. “This is about addressing the unique issues that family businesses have and giving people interested in that an opportunity to learn more.”

Student-Led Initiative

When John Stupp III began his Olin MBA in 2013, the school had no family business program, prompting him and fellow students to inquire with Gupta about developing a curriculum around the topic. He commissioned five students to analyze the feasibility of a formalized family business program.

From both a practical and theoretical standpoint, there are a significant number of differences among business approaches between family and non-family enterprises, Stupp said. They include issues of succession planning and estate taxes, as well as separating personal and business related-matters.

“The team felt the differences between family and non-family enterprises were drastic enough that it demonstrated a need,” Stupp said. He and his colleagues saw their vision grow further when Burke agreed to teach the family business course and begin to launch Family Business Program.

That program includes a half-semester course, a student-run club, and an annual symposium and speaker series. “These different avenues allow students to experience a diversity of theoretical and practice thought and gain insights into family business best practices,” Stupp said.

Stupp said his interest in family enterprises came about in part from his family’s 162-year-old business, Stupp Bros. Inc., which provides infrastructure development and banking services across the United States. While at Olin, Stupp said he wanted to prepare to continue his family’s tradition of success by learning more deeply about succession planning and how to effectively manage a business while separating family and professional matters. He now serves as director of project management for the company.

“Students get totally focused on big, publicly traded companies. They get no exposure to what family businesses are like,” Roger Koch said. “Family businesses by far create more jobs than any other sector of the economy. There are great careers to be had in family businesses. They’re very long-term oriented. They don’t only think about the next quarter.”

Global Impact, Regionally Based

Dean Taylor said expanding the family business initiative into a full-fledged research center supports Olin’s strategic plan by leveraging the school’s world-class research to create and disseminate knowledge in an innovative way and preparing students for careers in enterprises with global reach.

“Family businesses are among the biggest job creators internationally, nationally, and regionally,” Taylor said. “Therefore, we are thinking about how we can enhance our research and the body of knowledge in the area. We want to support and enhance family-run and closely held businesses.”

The existing course is not only popular with students who are planning to join or start their own family business, but it’s equally important to students planning to go into fields that work with family-owned businesses.

Such is the case of Jeff Wertenberger, MBA ‘18, an investment banking associate for financial services firm Robert W. Baird & Co. In his role, Wertenberger is occasionally confronted with situations that are specific to family-owned businesses. Taking the family business course and attending the symposiums helped him understand those situations more deeply.

Stupp and Wertenberger said all Olin students should be exposed to the dynamics of family businesses—even if they’re not family business practitioners. Even leaders who don’t work for family owned businesses are likely to work with them at some point in their career.

“It’s important to be knowledgeable of these unique dynamics, what motivates them and what’s important to them,” Wertenberger said. “That’s how important it is.”

Creating First-Hand Connections

In his curriculum, Burke brings real-life cases from around the world to illustrate the importance of understanding the nuances of family-owned businesses.

There are approximately 5.5 million family-owned businesses in the country, which Forbes magazine says contribute to more than 50 percent of gross domestic product and employ more than half of the nation’s workforce. As vital as they are to the nation’s economy, fewer than a third of all US family-owned businesses survive the transition from the first to the second generation of ownership. Another 50 percent don’t make it to a third generation.

“How can we—as students, as faculty, as a school—help the people in these businesses do a better job and how can we help the people who aren’t in the family businesses do a better job helping family businesses?” Burke said.

One component of the existing Family Business Program that will expand with the research center is the ability to study real cases and hear speakers from dozens of companies—including Todd Schnuck of Schnuck Markets, Sue McCollum of Major Brands, and Kyle Chapman of Barry-Wehmiller—at different generational stages and with a unique perspective to the craft.

The program also collaborates with the Olin Center for Experiential Learning, pairing students with family businesses on consulting projects to tackle different challenges unique to those firms, applying principles from the classroom to real-world problems.

“A course on family business taught with a case book would not be great,” Burke said. “What’s fun about this is the real-life examples that illustrates the conflicts and how challenging the resolution is.”

Taylor said he anticipates the Koch Center for Family Business will contribute to bettering local and global economies by preparing students to assist these unique, yet essential enterprises.

“It is part of our duty as an institution,” Taylor said. “We seek to have high impact internationally, nationally and regional—and this is an opportune area.”

For the Kochs, they envision a thriving Family Business Center as a world-class resource supporting academic research, preparing students to confront these unique issues, and driving long-term success for family business owners.

“We have friends who spend tens of thousands going to Stanford or Harvard to learn about these burning issues—and we think St. Louis could be one of those centers,” Paul Koch said. “We can make a mark in this area that would make us unique.”

KEY ISSUES

The dynamics of family-owned businesses pose unique challenges for business leaders. The challenges are substantial in a segment responsible for 80 percent of global job creation and 64 percent of the US economy.

- Succession planning and growth. Distribution of assets can become an issue as the business spans generations.

- Lack of transparency. Closely held firms hold information close to the vest, which constituents may view as being secretive.

- Competing motives. Profit may not be the singular success driver for leaders in family-owned businesses. They can be more purposeful, but their purposes may vary.

- Lines of authority. The person truly calling the shots may not have the title or the corner office, affecting how others effectively engage with a family business.

BY THE NUMBERS

Some key metrics about family-owned businesses.

- 82 percent of US survey respondents said they trusted family businesses versus 58 percent who trusted “businesses in general.” Globally, the numbers were 75 and 59 percent, respectively.

- Half of respondents know which companies they buy from are family owned.

- 81 percent of the world’s largest family businesses practice philanthropy.

- 25 percent describe family businesses as “transparent” in their business operations.

- 52 percent say they are “well-prepared” for a sudden succession.

- Of the world’s 500 largest family businesses, nearly 28 percent are in North America.

- One in five firms are family owned.

Sources: Edelman; EY Global Family Business Center of Excellence; Forbes.

The Koch Center for Family Business

A world-class resource supporting academic research, preparing students to confront these unique business issues.

Media inquiries

For assistance with media inquiries and to find faculty experts, please contact Washington University Marketing & Communications.

Monday–Friday, 8:30 to 5 p.m.

Sara Savat

Senior News Director, Business and Social Sciences