Research shows that, yes, headquarters can add value to business units

- November 17, 2020

- By Jill Young Miller

- 2 minute read

A central puzzle of corporate strategy is whether headquarters can add value to their business units beyond the burden of their own overhead.

The record is bleak: On average, corporations trade at a 20% discount relative to their breakup value.

“This is the problem that we want to try fix,” said Anne Marie Knott, Olin’s Robert and Barbara Frick Professor of Business.

She proposed and tested a theory of how corporations could overcome that record. On November 10, she presented the findings as part of the Olin Business Research Series. More than 60 people tuned in for the virtual event.

The 20% discount could mean that multibusiness firms fundamentally destroy value or that they are poorly managed. Regardless, a whopping $5 trillion economic gain could be had from a better understanding of how headquarters add value in multibusiness firms, Knott says.

Bank One and its return on assets

Bank One, a bank holding company, motivated the theory. Knott and co-author Scott Turner, of the University of South Carolina, explain how in “An Innovation Theory of Headquarters Value in Multibusiness Firms” in Organization Science.

Bank One increased the return on assets of its target banks by 40-70%.

“This would be really easy if they were purchasing underperforming banks,” Knott said. But they weren’t. They were buying well-managed banks.

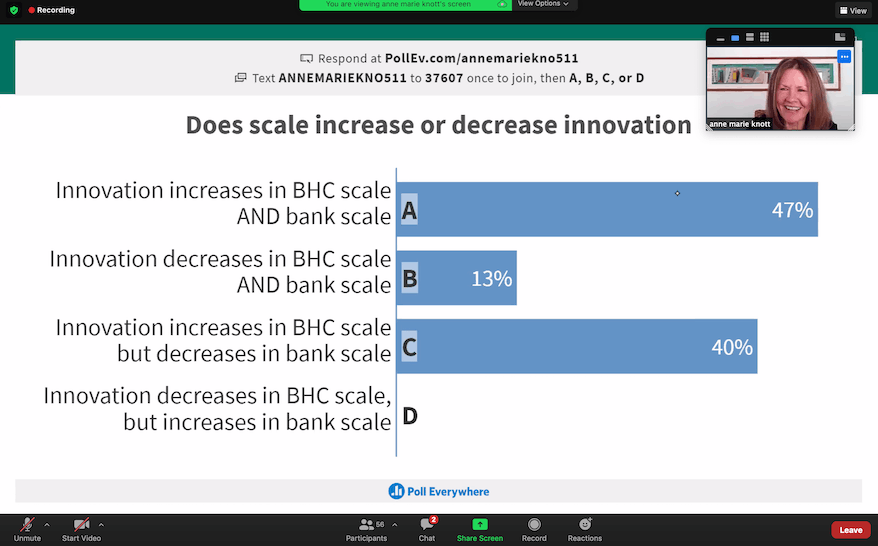

The theory relies upon dynamics between business units where laggard units improve their performance by imitating leaders. In turn, this “competition from below” stimulates leaders to innovate more.

Beyond demonstrating that headquarters can add value through innovation and growth, the theory offers prescriptions on how to do that. For instance, they can establish systems that create norms for sharing, which eases innovation. They also can offer high-powered incentives to fuel innovation.

In general, Knott’s research examines the optimal environment and policies for innovation, which she summarizes in her book, “How Innovation Really Works” (March 2017). This interest stems from issues arising during an earlier career in defense electronics at Hughes Aircraft Company.

KEY TAKEAWAYS:

- A $5 trillion economic gain could be had from a better understanding of how headquarters add value in multibusiness firms.

- Bank One increased the return on assets of its target banks by 40-70%.

- The theory relies upon dynamics between business units where laggard units improve their performance by imitating leaders.

- In turn, this “competition from below” stimulates leaders to innovate more.

Do company headquarters add value?

Olin Business Research Series presentation by Anne Marie Knott. Research also conducted by Scott Turner, University of South Carolina.

Media inquiries

For assistance with media inquiries and to find faculty experts, please contact Washington University Marketing & Communications.

Monday–Friday, 8:30 to 5 p.m.

Sara Savat

Senior News Director, Business and Social Sciences