A close look at the Ownership Insights course

- February 4, 2022

- By WashU Olin Business School

- 6 minute read

Olin’s central course on family business is “Ownership Insights: Strategic Leadership of the Family- and Employee-Owned Firm.” In this course, Spencer Burke, Eugene F. Williams Jr. Executive in Residence, and I (Peter Boumgarden) have spent the last few weeks identifying the choices owners face in their business and their respective impact on firm performance.

One framework for ownership decisions centers around Josh Baron’s helpful conceptualization of the five choices that owners can make in their business. It is nicely captured in his book, Harvard Business Review Family Business Handbook, which we both recommend. Josh argues that owners have the power to:

- Design the type of ownership you want (Design)

- Plan for the transition to the next generation (Transfer)

- Use effective communication to build trusted relationships (Communication)

- Structure governance to make great decisions together (Decide)

- Create an ownership strategy to define success (Value)

In this blog post, I want to show how this framework translates into teaching our students to understand the consequences of ownership decisions in the family firm.

Ownership choices and value constellations

One of the things I most appreciate about Josh’s tool is the clarity by which he brings out the potential choices in play for owners of organizations.

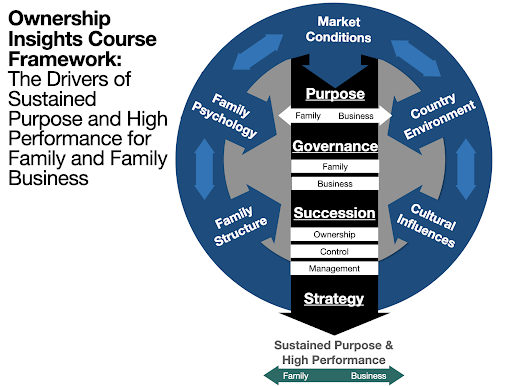

Amongst all of these five choices (design, transfer, communicate, decide, value), what I get most excited about with private enterprise is the possibility of intentionally defining value—or success—in different ways than those in other ownership forms. Our course, in particular, seeks to extend this work by formally filling out all the influences on ownership choices, from changing demographics and its impact on the family tree and succession to differences in cultural psychology across regions and how it shapes what is considered fair in different spaces. You can see the full framework below.

One of the critiques of family business as an ownership form is found in research by Nicholas Bloom, Raffaella Sadun, and John Van Reenen. Using the World Management Survey (WMS) as a tool, the researchers argue that family businesses with family CEOs are less well run than many other ownership forms in the market (dispersed shareholders, private equity controlled, etc.). A great deal of the power of this work is that companies that are independently scored high on these 19 dimensions empirically perform better on many measures of company financial performance than companies who score lower.While I like this research a great deal, if you dig into the “World Management Survey” items (here is a survey from retail, for example), it also becomes clear that these are not value-free items. Let’s look at three examples in particular to illustrate the point, with the item identified first, and the description of the top score identified after:

One of the critiques of family business as an ownership form is found in research by Nicholas Bloom, Raffaella Sadun, and John Van Reenen. Using the World Management Survey (WMS) as a tool, the researchers argue that family businesses with family CEOs are less well run than many other ownership forms in the market (dispersed shareholders, private equity controlled, etc.). A great deal of the power of this work is that companies that are independently scored high on these 19 dimensions empirically perform better on many measures of company financial performance than companies who score lower.While I like this research a great deal, if you dig into the “World Management Survey” items (here is a survey from retail, for example), it also becomes clear that these are not value-free items. Let’s look at three examples in particular to illustrate the point, with the item identified first, and the description of the top score identified after:

- CONSEQUENCE MANAGEMENT – Top Score: A failure to achieve agreed targets drives retraining in identified areas of weakness or moving individuals to where their skills are appropriate.

- TARGET INTERCONNECTEDNESS – Top Score: Corporate goals focus on shareholder value; they increase in specificity as they cascade through business units ultimately defining individual performance expectations.

- RETAINING TALENT – Top Score: We do whatever it takes to retain our top talent.

Many of us can see why companies like this might perform well and perhaps be the kinds of companies we might want to invest in or work for. But, for the sake of argument, let’s consider another company wedded to a different set of values along these exact dimensions.

- CONSEQUENCE MANAGEMENT – “At Company X, we set clear goals for our people but build in a care for people when they don’t perform at expectation, knowing that circumstances sometimes sit outside one’s control.”

- TARGET INTERCONNECTEDNESS – “As owners of Company X, we desire strong shareholder performance, as that is in our financial interest. That said, we want to ensure that multiple stakeholders of the business, from you as employees to the communities we sit within, matter a great deal. As such, if we add value for those other groups and this sometimes occurs at the expense of shareholder value, we will still consider that a good year.”

- RETAINING TALENT -”We want you to perform well here. That said, we know that this might not be the fit for your forever. As such, if this company is not the best place for you, we want you to know that we care about you enough to want to find the best fit for you moving forward, even if that place is not here.”

I bring up these points of comparison not to suggest that the latter is a better way of performing, but rather to show how you could see an owner setting up their business like this and thus defining value in a very different way. In many ways, our economy functions in healthy ways when it is represented by companies reflecting a wider plurality of value positions, and not all of the same ownership model (private, public, PE owned, family owned, employee owned, etc.)

The lived philosophy in family and private enterprise

We have seen many of these differences reflected in the comments from class speakers, someof whom have already shown up and others to come in the next few weeks:

- Matt Villa (2nd Gen), Villa Lighting

- Ross Millman (4th Gen), Millman Lumber

- Elizabeth Niedringhaus (2nd Gen), SSE

- John Jennings, St. Louis Trust and Family Office

- Mike Lefton (2nd Gen), Metal Exchange Corp

- Ryan Plotkin (2nd Gen), M-D Building

- Kristi Humes (2nd Gen), Tacony Corp

- Eric Gilbert (2nd Gen), Anova Furnishings

- Ted Briscoe (Multi-Gen), Sydenstricker Nobbe Partners

- David Weiss (1st Gen), Podiatry Growth Partners

This summer, I was on a long run with a good friend, Chris Bolyard. Located in the Maplewood neighborhood of St. Louis, Chris’ butcher shop, Bolyard’s Meat and Provisions, is one of Food and Wine’s Best Butcher Shops in America. On the run, Chris and I got to talk about whether he would ever open multiple shops or grow his enterprise outside of St. Louis. We had a few mutual friends who had done similar things with their restaurants, so you could see what might be appealing. While Chris didn’t outright say he wouldn’t do those things, it became clear that this was not a fundamental priority for his business. He saw the strain this would have on his family, his lifestyle, and perhaps even his ability to keep the same quality standards across the operations.

Chris’ north star is on product quality and serving his neighborhood customers over and above rapid growth and expansion. To take it a step further, even if he did move to multiple locations, it is clear that Chris does not aspire to be Tyson Foods. So, would it be fair to compare Tyson Food to Bolyard’s Meat and Provisions? No, for in many ways, these two are running in fundamentally different races.

Ownership strategy to define and drive value

The trap that a family business center like ours needs to avoid is believing that our mission is to tell our audience a set of sugary truths we think they want to hear. This belief might lead us to make claims that are empirically hard to justify (“Family ownership of any form is the best ownership form in the world, in all times and all places”) . As a research based institution, this is not a path we should or will follow.

At the same time, the challenge for many business schools in the world is we too often have bought into an overly narrow, quantitative, and academic view of value (“shareholder value”, “ROIC,” “IRR,” “professionalism”) and have a hard time seeing what other constellations of value choices can be just as compelling. At the Koch Center, we hope to explore some of these distinct concepts of value and the strategic implications of organizing around such structured purposes.

There are significant challenges for most family businesses: the incentives of family shareholders, the challenges of maintaining family harmony through different business ups and downs, a family which grows faster than a business, fairness in succession of ownership, control, and management, amongst others—many of which we address in the course and the programming of the Center. With that said, what is compelling about the closely held business, whether family, employee or privately owned, is the opportunity to define a distinct set of values, and then organize a strategy and structures around such ends. Doing this well is hard work. At the Koch Center, we hope to contribute to this important task through a mix of academic clarity and educational expertise for those within and outside the halls of Washington University.

Media inquiries

For assistance with media inquiries and to find faculty experts, please contact Washington University Marketing & Communications.

Monday–Friday, 8:30 to 5 p.m.

Sara Savat

Senior News Director, Business and Social Sciences