Wealth & Asset Management Concentration

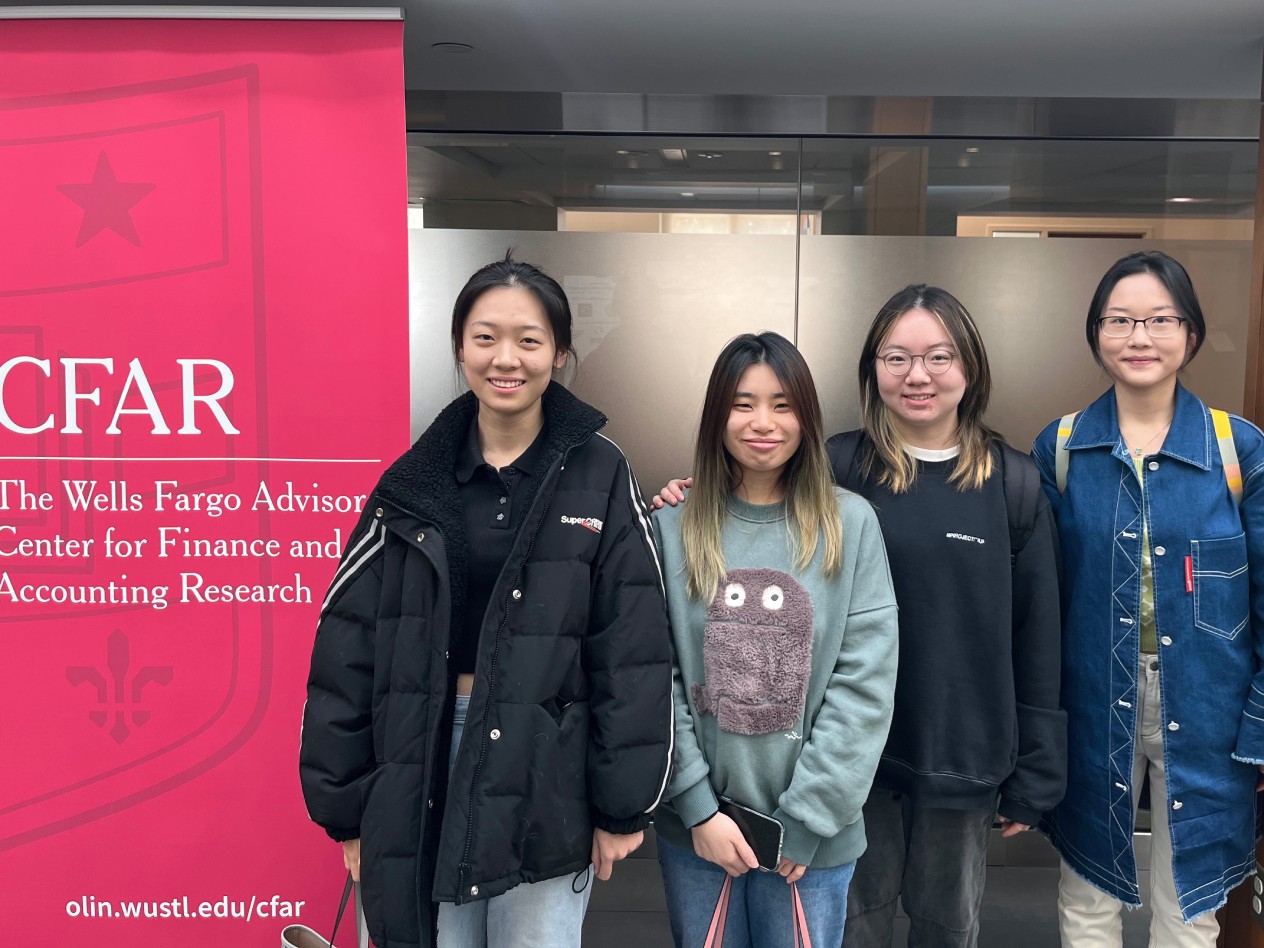

This STEM-designated concentration is designed to prepare you for the wealth management industry — advising individuals, institutions, and firms. Your learning focuses on financial markets and portfolio construction, financial scenarios modeling and mastery of financial plans, market ratios, and investment ratings. You can enhance your academic experience by engaging with the Wells Fargo Advisors Center for Finance and Accounting Research. The coursework also prepares you for the Chartered Financial Analyst (CFA) Level 1, Certified Financial Planner (CFP) exam, Series 7 for a General Securities Representative or the Chartered Alternative Investment Analyst (CAIA) exam.

-

Location

St. Louis -

Duration

18 months -

Format

On campus -

Start

Fall

STEM designated

Our wealth & asset anagement concentration has a STEM designation for its curricular focus on science, technology, engineering and mathematics.

Learn more about STEMWealth and asset management curriculum

Prerequisites: Applicants should have taken Calculus I, Statistics, and Microeconomics.

Total credits: 39

Required: 28.5 credits

Electives: 10.5 credits

Core coursework includes:

- Business Analysis Using Financial Statements

- Advanced Business Analysis Using Financial Statements

- Advanced Corporate Finance I – Valuation

- Advanced Corporate Finance II – Financing

- Investment Theory

- Fixed Income Securities

- Investments Praxis

- Options & Futures

- Derivative Securities

- Introduction to Python & Data Science

- Database Design & SQL

- Quantitative Risk Management

- Professional Business Communication

Electives include, but are not limited to:

- Financial Industry Platform

- Venture Capital Methods

- Venture Capital Practice

- Private Equity Methods

- Private Equity Practice

- Mergers & Acquisitions

- Behavioral Finance

- Hedge Fund Strategies

- Endowments, Foundations & Philanthropy

- Wealth Management Practice

- ESG Investing

- Introduction to Blockchain & Cryptocurrencies

Required experiential course options

Choose one of the following to complete the experiential learning component of the degree:

- Center for Finance and Accounting Research Practicum

- Internship, Business & Application

- Applied Problem Solving for Organizations

Hands-on experience in portfolio management

Olin SMP team takes third in national competition with 23 teams from 18 b-schools.

Read moreCareer prospects

Some career paths for this program include: Account Manager, Equity Trader, Derivative Trader, Private Equity Analyst, Junior Consultant

Learn more about career prospects

Which finance path is right for you?

We have programs for Quantitative, Wealth and Asset Management, Corporate and Global Finance.

Learn moreQuick Links

Contact Us

Graduate Admissions

Olin Business School - Knight Hall

One Brookings Drive

St. Louis, MO 63130-4899

Office Hours:

Monday–Friday, 8:30 a.m. to 5:00 p.m.