Insider tour of New York Federal Reserve

- May 26, 2017

- By Nate Quest

- 5 minute read

We were fortunate enough to begin the morning of May 17 with a speaker from Waterfall Asset Management–the visit had been rescheduled from Monday. The incident that had occurred on Monday was able to serve as an interesting case study of sorts for us. Our speaker had placed a bid for a product, but his bid had been only the second- highest submitted. He explained to us both the positive and negative lessons to be learned from this incident. The first lesson is that, in certain instances, being second best only signifies that one is the best loser. He did clarify, however, that this does not always hold true. To paraphrase him, the person who graduates last from medical school is still referred to as “Doctor.” The second lesson is that it is sometimes advantageous to lose. The entity that had outbid him for the product had done so by a wide margin. As this was the case, the entity should probably reassess the risk profile of the product that they purchased. As no other entity thought it was even close to the value as they did, it is probably riskier and worth less than what was paid for it.

Most importantly, we learned about the mindset that finance professionals should approach their careers with. The speaker stressed the significance of humility and gratitude and how those virtues remain the guiding lights that have allowed him to achieve both great professional and personal success. It was inspiring to see that there truly are those who maintain such strong moral fiber in a profession which is so often (and sometimes falsely) accused of being bankrupt.

Finance professionals rely on objective and timely information to make significant investment decisions in their business. We were honored to hear from a journalist from The Wall Street Journal, the most popular and probably most profitable newspaper in the finance field, that virtually every successful professional reads every day. The speaker introduced to us how the Journal gathers all kinds of resources to form an objective and independent reporting about the market to inform the world of finance.

In the afternoon, we departed for the New York Federal Reserve Bank on Wall Street, and there we had an insightful tour of not only the history of Federal Reserve System, but also its structure and functionality as the central banking system of the United States. Essentially, the Federal Reserve System, founded in 1913, is created to tackle the issues of financial panics. The system is composed of twelve regional banks located in a variety of cities in the U.S., such as St. Louis, Cleveland, New York, and so forth. When the board of governors of the Federal Reserve System along with the 12 presidents of regional federal reserve banks have decided to act on certain mutually agreed monetary policies, the New York Federal Reserve Bank will take the lead in carrying out the monetary policy implementation with all other Federal Reserve Banks.

What’s noteworthy is that the term length of all board members on Federal Reserve Board of Governors is set out to be a staggering 14 years, which is designed to promote independence of the board’s decision making process without being influenced by higher powers of authority.

Since the crisis of 2007, the Federal Reserve has been more conservative in loosening money supply. As time passes, the objectives of the Federal Reserve System appear to have shifted from preventing financial panic to promoting social stability by stabilizing the inflation rate and maintaining a natural unemployment level. This shift in functionality of the Federal Reserve System is enforced by open market operation, that is, buying and selling of government issued bonds in the open market to control the amount of money in circulation. In addition to OMO, Federal Reserve Banks can adjust policy rate/reserve rate and the interbank interest rate.

A tour of the New York Federal Reserve Bank has provided us a different perspective on how we ought to look at the function of Federal Reserve as well as its monetary policy.

Later in the afternoon, we visited the Museum of American Finance, which features exhibits on the financial markets, currencies, banking history, and more. It unfolds the development of the market from different perspectives through diverse exhibitions.

For example, there’s a collection of used forms of currency and payment instruments, from coins to point-of-sale (POS) machines and Square magnetic stripe readers. The history of coins extends from antiquity to the present and has witnessed the ups and downs of economic history. Additionally, the new forms of payment methods such as the Square reader has carried more convenience into daily businesses, and it reflects the transformation that advanced technology and innovation have brought in recent decades.

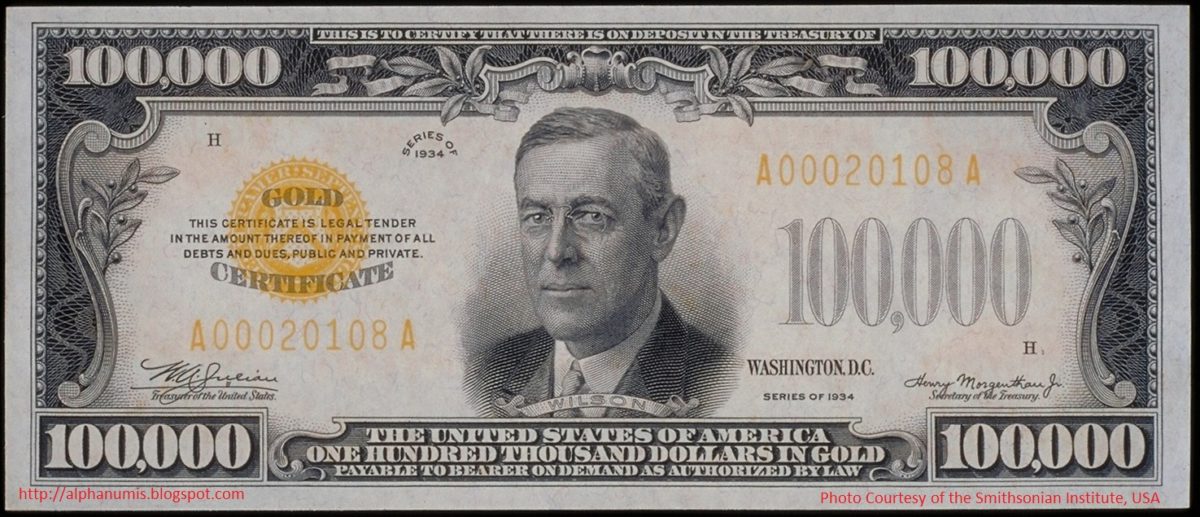

We also saw the exhibition of high currency notes. Money serves as a medium of exchange and has value embedded. Therefore, turbulence in politics and economics could be reflected in unusual currencies such as inflationary currency. For instance, the Federal Reserve issued $100,000 gold certificates in 1934 in the aftermath of World War II.

Moreover, there are photographs showing the old exchange floor and the booth that was used before the implementation of the electronic trading system. However, no matter how the trading system has been upgraded, the passion and energy on Wall Street has never changed, and will continue to play an important role in American and global finance.

At nightfall, we gathered around on the 27th floor Terrace, chatting with each other and appreciating the view of flourishing New York. During the event, many exquisite dishes and drinks were provided and everyone enjoyed themselves. Among those in attendance were WashU alumni who are financial industry talents who shared plenty of valuable career advice and their work experience with us. It was great to have a roof top talk with alums of all ages today.

One alumna with whom we networked today got both her undergraduate and master’s degrees from WashU. She was a former Ernst & Young consultant and is now in a 15-year-old startup consulting firm based in New York City. Talking to her was rewarding. She generously shared information about consulting careers and her daily work content. Learning new knowledge efficiently and fast is one of the core qualities of being a consultant, and researching and knowing clients’ industries are a very important step of showing respect and professionalism to the clients. She also offered a job opportunity from the company in which she is currently working. However, she responsibly stressed that any of us who wants to apply for this job must be truly interested in a career in consulting instead of treating it as a stepping stone to other careers. Most of us had a great time at this event, and it was honorable for us to meet the alumni and learn from them.

Guest Bloggers: Jingyi Duan, Sheng Jin, Jie Tang, Lingfeng Zhu (GMF 2017)

This is a series of blogs chronicling the experiences of 42 Global Master of Finance (GMF) dual degree students during their two week immersion course in New York and Washington, DC. Each blog will be written by a small subset of students during their experience. Names of speakers and presenters at firms are anonymous at the request of the firms and course organizers.

Media inquiries

For assistance with media inquiries and to find faculty experts, please contact Washington University Marketing & Communications.

Monday–Friday, 8:30 to 5 p.m.

Sara Savat

Senior News Director, Business and Social Sciences