Olin 1st in prestigious Quinnipiac finance competition

- March 30, 2018

- By Kurt Greenbaum

- 3 minute read

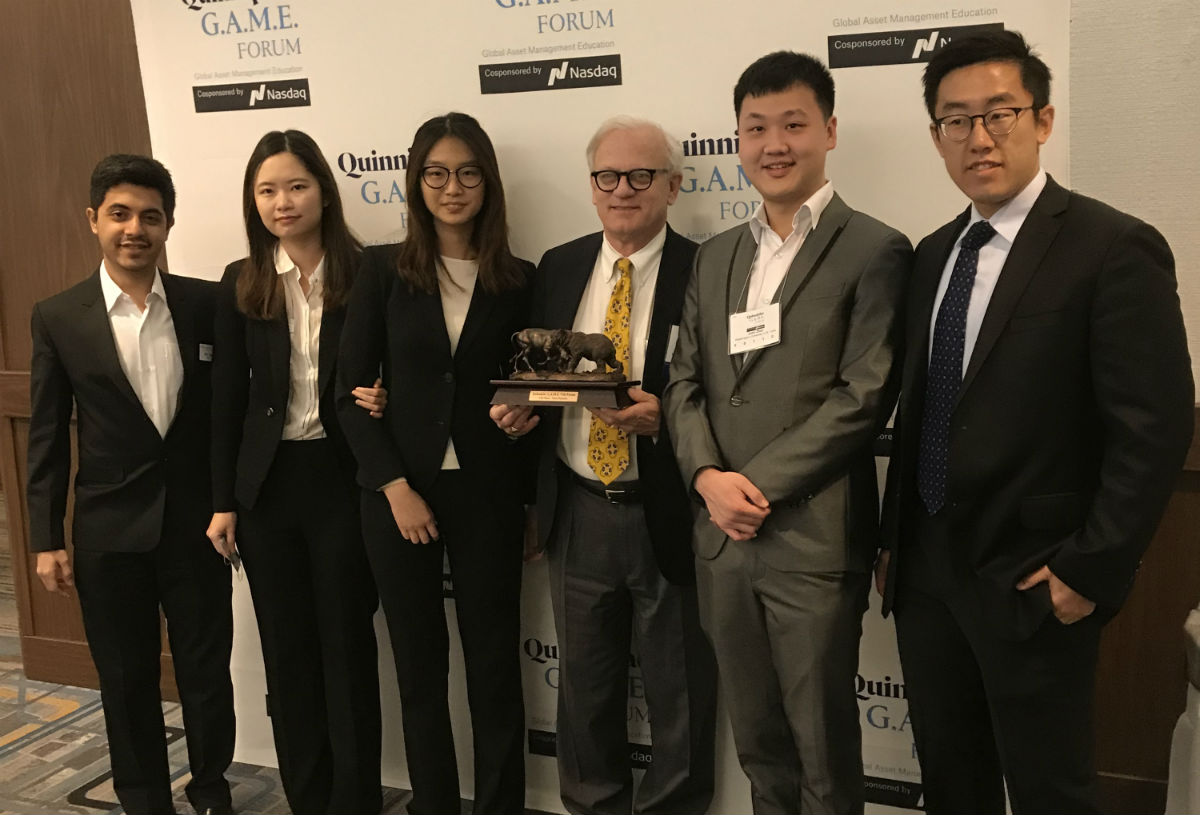

After fighting through a wicked winter storm, five WashU students and their adviser made it to midtown Manhattan in time to impress judges with their financial savvy and take first place in the “value investing” division of the prestigious Quinnipiac G.A.M.E. Forum.

The conference and competition fell in the midst of the fourth winter nor’easter that tromped over New York and surrounding areas. Faculty adviser Timothy Solberg dashed over deserted freeways on March 21 after his New York flight was diverted to Boston. Early that morning, Rishi Masand, MSF 2018, caught one of the last flights out of Boston before airports closed.

Teammates Claire Chen, Pei Li, John Zhao, all MSF 2018, and Tony Chen, BSBA 2018, got in late the next day. But in the end, their preparation and performance distinguished themselves among 75 teams that submitted proposals to the judges.

“To be narrowed down to winning one of these categories is a real achievement,” Solberg said. “The students did a great job in their presentation.”

Outgrowth of Investment Praxis Course

The competition was one of the highlights of the finance conference that drew hundreds of students from 150 different schools to New York for the weekend. The competition pit teams of finance students against each other, each one making a presentation to share an investment strategy—and their results—with judges. The teams were evaluated based on the students’ ability to explain the investment philosophy taught in their praxis.

In Olin’s case, the students had to convey their conservative, fundamental “value” analysis, oriented toward lower risk equities, with lower price-to-earnings ratios and higher dividend yields.

For the WashU students, their portfolio was more than theoretical. The students participate in WashU’s “investment praxis” course, taught by senior lecturer Charles Cuny and facilitated with Solberg. In the course, students manage a $1 million segment of Washington University’s endowment.

“It’s live money they were managing. It’s a real-world portfolio,” Solberg said. “I think it shows very well for the analytical skills that the students learn at Olin. It’s very hands-on kind of training for the students.”

The students spent nearly two months working on their Quinnipiac presentations, meeting Wednesday evenings and Friday mornings each week to analyze financial results, review their strategy, and organize their presentations into the required format.

“We buy stocks with conviction. We don’t go in with a trading mindset,” said Rishi, speaking for the team after the competition. “That’s how we pitched our portfolio. I guess that also helped us. We picked stocks we think we understand.”

In the end, the students realized their portfolio had returned 19.2 percent over the course of the year, underperforming the S&P 500 index by 2.6 points. Tracing their performance back, the students realized they had held cash out of the market during a particularly lucrative uptick.

When they broke down their portfolio by industry, however, they realized they had outperformed six out of 10 market segments. Even more, Solberg said, “Pure value stocks, measured by the Russell 1000 Value Index, returned 5 percent less than our portfolio, which indicated strong value management by our students.”

Rishi added, “I think we showed that we had a clear idea of what our portfolio looked like. It was a little easier to see why those stocks had been picked a year back.”

During the trip, Solberg took the students on a variety of side-trips, including a visit to Bloomberg to learn more about the company’s operation—and learn the finer points of working a Bloomberg terminal.

Rishi said the competition win was big news for Olin.

“We didn’t really know how portfolios are represented in the real world, so Tim was able to help us with that,” Rishi said. “It was a mix of having access to the right tools, to the right professors, and having built up that understanding of corporate finance through the last year.”

Media inquiries

For assistance with media inquiries and to find faculty experts, please contact Washington University Marketing & Communications.

Monday–Friday, 8:30 to 5 p.m.

Sara Savat

Senior News Director, Business and Social Sciences