Olin-Brookings panel probes “Main Street’s Tidal Wave of Transition” in closely held business

- December 4, 2023

- By Kurt Greenbaum

- 4 minute read

As the founders of cornerstone family-owned businesses age and contemplate what becomes of their life’s work, critical questions emerge about the nature of family ownership and its effect on the US economy.

In an economy that employs more than 130 million workers in companies with fewer than 100 employees, accounting for a substantial proportion of gross domestic product, what form will the economy take in the midst of such a significant ownership transition? How will private equity firms and other investors influence the way wealth and corporate ownership are passed to the next generation? What will this transition mean for job growth? What transition alternatives can (or should) aging founders use as they retire?

These are some of the questions confronting a new panel of experts representing business owners, private equity firms, antitrust regulators and business strategists from WashU Olin Business School, the Brookings Institution and beyond.

The project—“Main Street’s Tidal Wave of Transition”—is the third of three created under the auspices of the Olin Brookings Commission, a multiyear initiative underwritten by The Bellwether Foundation Inc. to research and gather data on megatrend topics affecting the quality of life in our communities.

“I am most excited for this commission to address an important question that has both philosophical and empirical foundations: What kind of economy do we want, and what happens when the ownership transitions from one form to another?” said Peter Boumgarden, chair of the commission and director of Olin’s Koch Family Center for Family Enterprise. “These are really big questions, but ones that I think we fail to think about with enough precision.”

Team of experts

In addition to Boumgarden, the 2023-2024 commission includes:

- Brendan Ballou, author of Plunder: Private Equity's Plan to Pillage America, served as special counsel for private equity in the Justice Department

- Ronnie Chatterji, Mark Burgess & Lisa Benson-Burgess Distinguished Professor, Duke University’s Fuqua School of Business

- Aaron Klein, Brookings’ Miriam K. Carliner Chair–Economic Studies and senior fellow for the Center on Regulation and Markets

- Mike Mazzeo, dean, WashU Olin Business School

Olin faculty providing research support for the project includes:

- John Barrios, assistant professor of accounting

- Seth Carnahan, associate professor of strategy

- Bart Hamilton, Olin’s Robert Brookings Smith Distinguished Professor of Entrepreneurship

- Margarita Tsoutsoura, associate professor of finance

Aditi Vashist, an Olin PhD candidate in organizational behavior, will be the linchpin for student involvement in the project.

I am especially grateful that the Bellwether grant allows us to engage students in this research.

—Peter Boumgarden

“I look forward to working with a set of WashU students from all across the university as we find a way to move the ball down the court.”

Optimal transition outcomes

With an estimated $100 trillion of net worth on the verge of being passed to successors or inheritors or ultimately sold in the marketplace—a phenomenon often referred to as a looming “silver tsunami”—the commission aims to suggest policy changes that might result in a more optimal pattern of financial and non-financial outcomes. That work involves examining issues such as:

- The landscape of transition and the benefits of certain forms of transition over others.

- The financial and nonfinancial outcomes implicit in different forms of transition (e.g., bankruptcy rates, the degree to which these companies provide good jobs, the amount of capital that stays in the community).

- The financial and nonfinancial outcomes inherent in the use of private equity, a prominent and growing ownership alternative.

- The policy landscape and broader cultural forces affecting transition.

The commission intends to meet several times in a variety of locations over the next few months, with a final report delivered at the Brookings Institution in October 2024. This aligns with the work of the previous two Olin Brookings Commissions.

- The 2021-2022 commission tackled the US opioid crisis, recommending using an AI-powered anomaly detection system to curb bad shipments.

- The 2022-2023 commission examined strategies for closing the startup funding gap for women and underrepresented minorities.

“Our team is top-notch,” Boumgarden said. “By linking four amazing scholars from Olin with people who live in the world of business, investment and policymaking, we hope to come up with novel insights that are needed to build real economic value.”

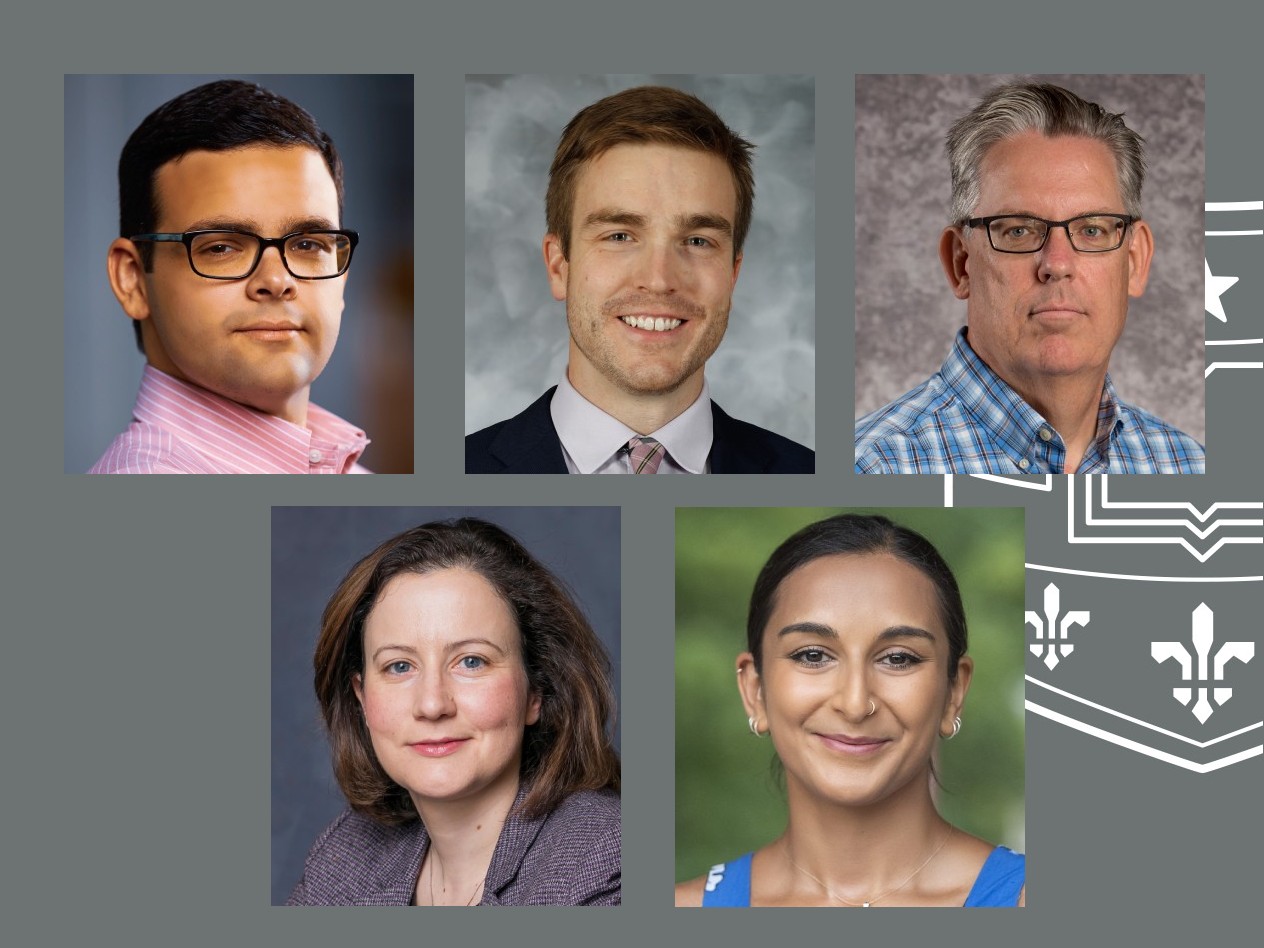

Pictured at top: The six members of the 2023-2024 Olin Brookings Commission. Top row, Ballou, Boumgarden, Chatterji. Bottom row, Gorguze, Klein, Mazzeo.

Media inquiries

For assistance with media inquiries and to find faculty experts, please contact Washington University Marketing & Communications.

Monday–Friday, 8:30 to 5 p.m.

Sara Savat

Senior News Director, Business and Social Sciences